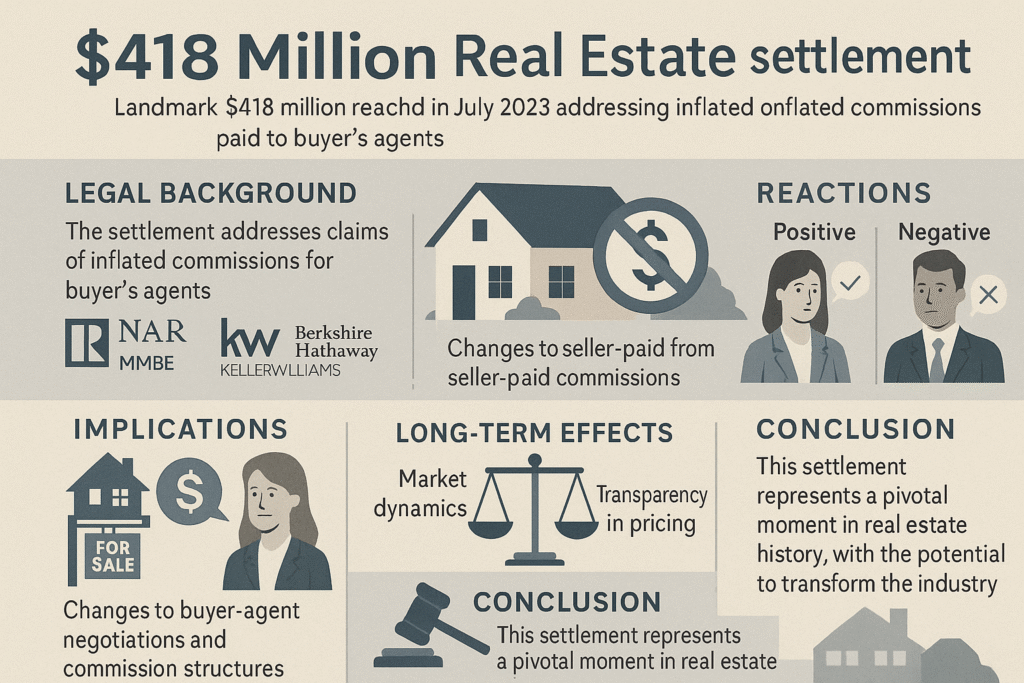

In an unprecedented move within the U.S. real estate sector, a landmark settlement reached in July 2023 is set to transform how homes are bought and sold across the country. This settlement, valued at $418 million, resolved multiple lawsuits that accused the National Association of Realtors (NAR) and major brokerages of conspiring to inflate commissions paid to buyer’s agents. Once approved by the federal court, this settlement will change the structure of real estate transactions that have been in place for decades.

The Settlement and Its Significance

On July 12, 2023, the NAR agreed to a $418 million settlement to end a legal battle involving several home sellers from Illinois, Missouri, and Kansas. These plaintiffs filed lawsuits alleging that NAR and large brokerages like Berkshire Hathaway’s HomeServices of America and Keller Williams participated in illegal practices designed to inflate the commission rates paid to buyer’s agents. The longstanding norm in the real estate market was that the seller covered both the seller’s and the buyer’s agents’ commissions. Under the new settlement, buyer’s agents will now negotiate their compensation directly with their clients, fundamentally changing how commission structures operate. The settlement, once finalized, would effectively end the practice of seller-paid commissions, creating a ripple effect in the entire industry.

Legal Ramifications and Industry Players Involved

The lawsuits, which were spearheaded by home sellers, accused major real estate firms of using their collective influence to artificially inflate commissions. This legal battle took a dramatic turn when a federal jury in Kansas City found the defendants guilty of these practices, resulting in a monumental $1.78 billion damages award. The ruling highlighted the necessity for reform in commission structures, as the high financial stakes illustrated just how much the inflated commissions had been affecting both buyers and sellers in the market. Prominent players such as Keller Williams and HomeServices of America were directly involved, and this ruling served as a wake-up call for the broader real estate industry, signaling a need for greater transparency and fair practices in commission dealings.

Immediate Reactions and Market Dynamics

Following the announcement of the settlement, reactions from real estate professionals have been mixed. Some agents have voiced concerns that the shift could lead to higher upfront costs for homebuyers, as buyers will now be required to negotiate commissions directly with agents. This change could also potentially reduce the number of real estate agents in the market, as smaller agents may struggle with the shift. On the other hand, there are those in the industry who see this as an opportunity to promote more transparent, competitive pricing, which could help attract buyers who value clarity in commission structures. In cities like Washington, D.C., for example, the average commission rate for buyer’s agents dropped to 2.35%, signaling an initial response to the settlement’s influence.

Long-Term Outlook for the Real Estate Industry

The long-term implications of this settlement are still unfolding, but it is clear that the structure of real estate commissions is poised for significant change. By mid-July 2023, discussions began to center around a new model where buyer’s agents are required to negotiate their fees upfront with their clients. While this could lead to more competitive pricing and greater transparency, it also poses challenges. For instance, buyers may face higher costs if agents increase their fees to compensate for the changes, or some buyers might be deterred from using agents at all.

Furthermore, agents will need to adapt to these new business practices and refine their marketing strategies to ensure their services remain attractive to potential clients. This may lead to a more fragmented market, but it could also pave the way for a system where real estate services are priced in a way that more closely aligns with the true value of the services provided, rather than being artificially inflated through industry-wide agreements.

Conclusion

The $418 million settlement reached in July 2023 stands as a pivotal moment in U.S. real estate history. It not only addresses longstanding concerns about commission practices but also signals the start of a new era in real estate transactions. As the industry adapts to these changes, the future of buying and selling homes in the U.S. is likely to be more transparent and competitive. The full impact of these adjustments will take time to unfold, but the landscape of real estate has undoubtedly been changed forever.