Opportunity Zones: Proposed Reforms and Future Outlook

The Opportunity Zone (OZ) program is once again in the national discussion as federal legislators propose significant modifications to this initiative, originally established to channel private investment into economically distressed areas. Launched in 2017, the program has successfully attracted over $40 billion in capital, although its effectiveness has been debated. With the designation periods nearing expiration in 2026, lawmakers are currently evaluating a major revamp that could significantly impact investment strategies.

Proposed Legislative Changes

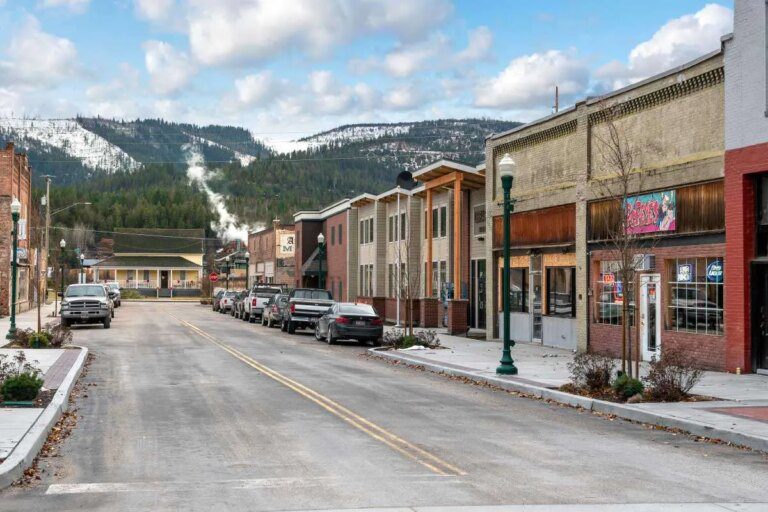

The anticipated legislation, integrated into a comprehensive tax package in the House, seeks to extend the OZ program until 2033. One notable adjustment includes a second wave of area designations that would compel states to incorporate certain entirely rural tracts. This expansion aims to broaden the focus from predominantly urban coastal areas to incorporate small-town America.

Incentives for Rural Investments

Under the proposed framework, investments made in rural Opportunity Zones would benefit from enhanced tax incentives. Key features include:

- A 30% step-up in basis after five years.

- Lower thresholds for substantial improvements, adjusted to just 50% of the original basis.

Impact on Commercial Real Estate Development

These changes could result in new opportunities within the commercial real estate domain, particularly in areas such as:

- Multifamily housing developments

- Adaptive reuse projects

- Infrastructure initiatives

Moreover, developers would gain additional flexibility, enabling them to defer up to $10,000 in ordinary income—not solely capital gains—when investing in eligible projects.

Enhancing Transparency and Accountability

Among the most significant proposed reforms is the push for increased transparency. Funds would now be mandated to disclose critical metrics such as:

- Creation of residential units

- Job creation impacts

- Investment volumes categorized by census tract

The Treasury Department is also expected to publish annual reports detailing the performance of designated zones, providing valuable insights for both investors and policymakers about the effectiveness of these investments.

Challenges Ahead

While these reforms present promising prospects, they are not without hurdles. A significant concern is the anticipated one-year gap between the expiration of current designations in 2026 and new designations in 2027, which could potentially stall capital investment during this period. Additionally, while the new reporting requirements aim to connect investments with community benefits, they may impose new compliance challenges for stakeholders.

The Path Forward

As the Senate prepares to deliberate on this bill in the coming weeks, the crucial question remains: Will these proposed reforms transform Opportunity Zones into a more focused and measurable development strategy, or merely reframe existing practices with a fresh tax timeline?